Version Française disponible ici

Sale pricing can be setup in different ways in MSDyn365FO, with sale price from the item itself, with trade agreements, with sale agreements, and also with trade allowance management if you want to setup special discounts or rebates. There is also a more complete princing policy when you use the retail functionalties. But here I will focus on the lump sum trade allowance agreement, which is use when a customer of your company has done something helpful for you, like displaying advertising in their office or shop, etc. It could have help your sales to increase, so that’s why your customer has negociate with you an amount to be given to him, calling a lump sum.

You can retrieve him by using a supplier account, by giving him some credit note. I’ve been following the DLP tutorial and found something strange about accounting transactions so here is my advice if you want to use it.

Note : even if those screenshots are in french I’m sure you’ll get the idea.

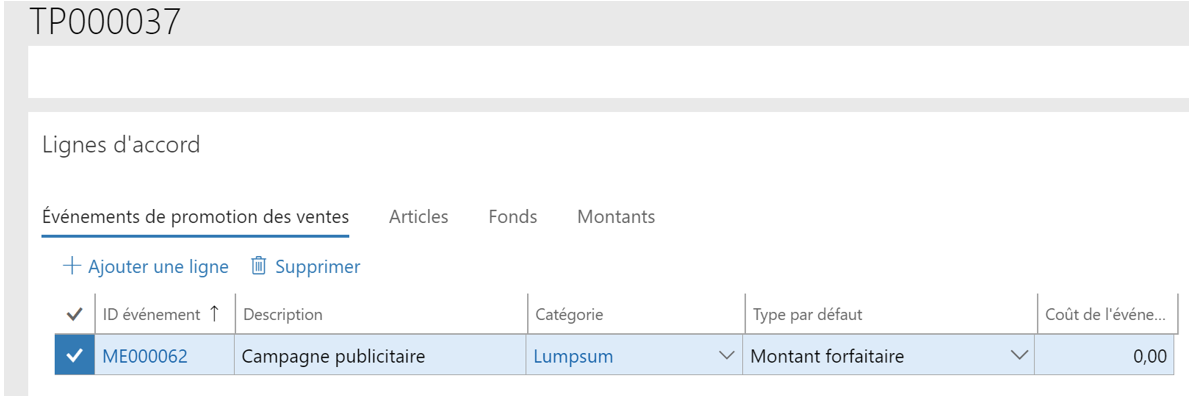

Setup the lump sum agreement

At first, you need to setup your agreement. After choosing the customer/product, you select the default type as lump sum.

Then, after confirming the agreement, you will approuve the amount negociated with your customer, in that case 80 USD.

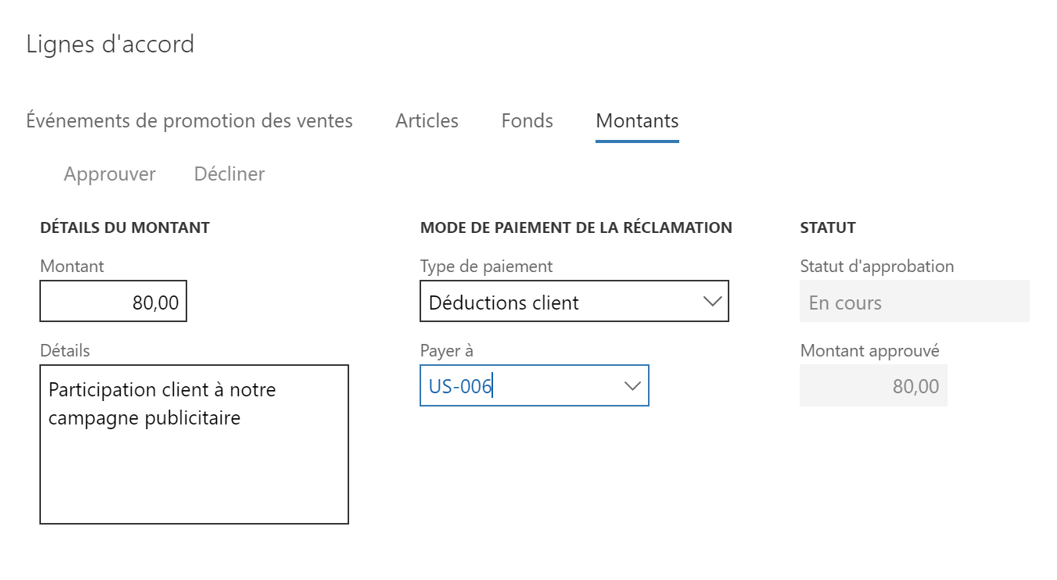

Then you may get this message

That means a free text invoice has been generated.

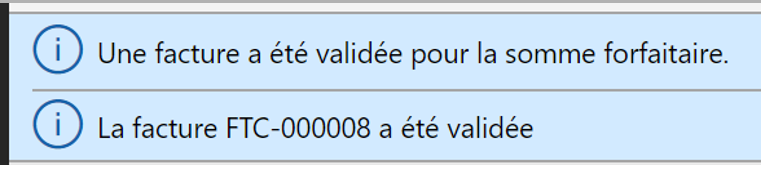

Going under the free text invoice menu, I can find my FTC-000008 record :

Now, analysing the ledger entry, I’ve got :

OK, let’s sum up : Credit on 130100 for 80 USD, Debit on 601600 : 80 USD.

Note : I’m running this test on a USMF environnement, so it’s US chart of account here.

Settlement

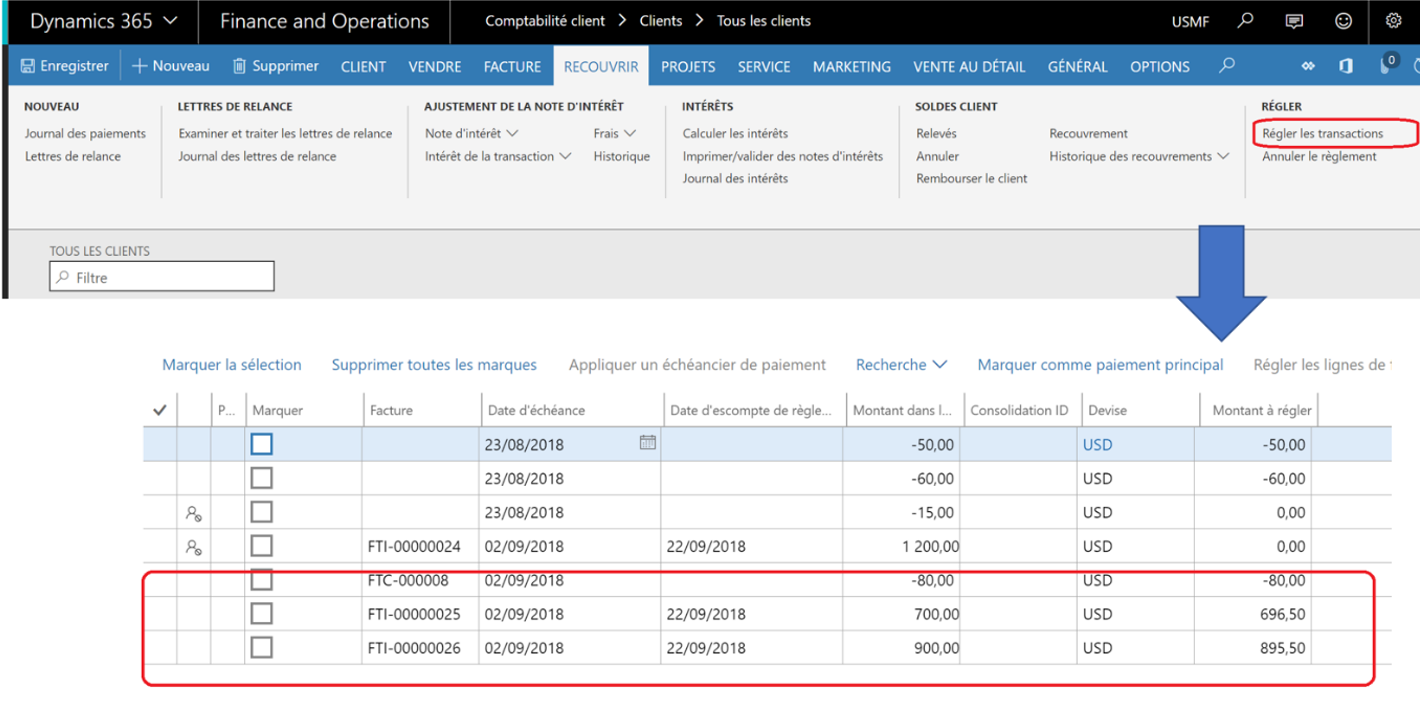

Now let’s proceed to the settlement. I’m going under the customer, and choosing the settlement option.

The customer has invoices to pay, and the FTC-000008 is retrieved here as we can see.

Now let’s follow what is done under DLP.

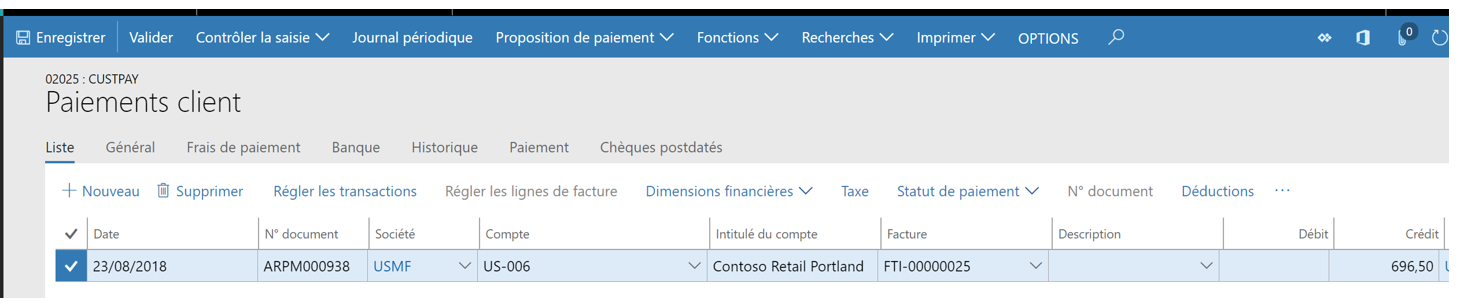

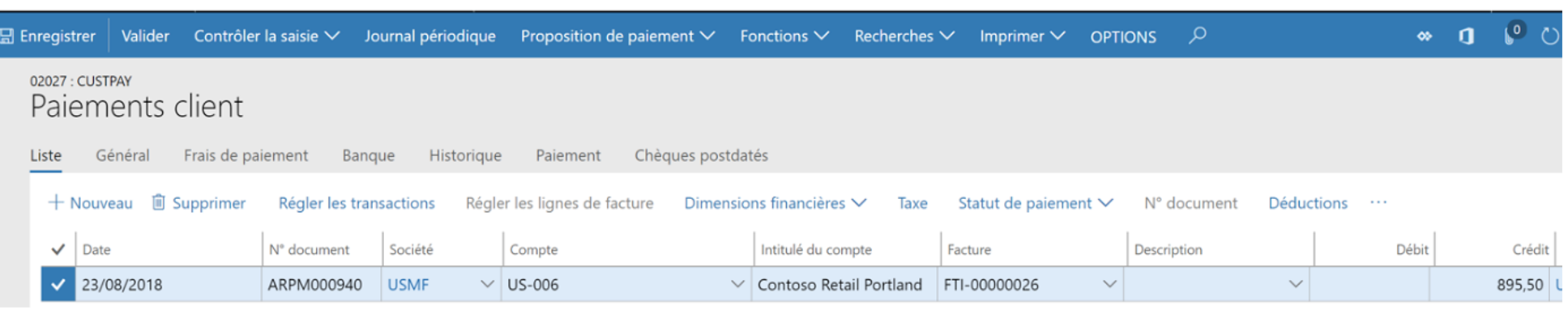

I’m creating a payment journal, finding an existing invoice the customer need to pay me (the number 25 for instance), and then I click on Deduction on the right.

Note : you cannot use the deduction if you haven’t filled at first with an existing invoice due by your customer. That’s not a good point to start.

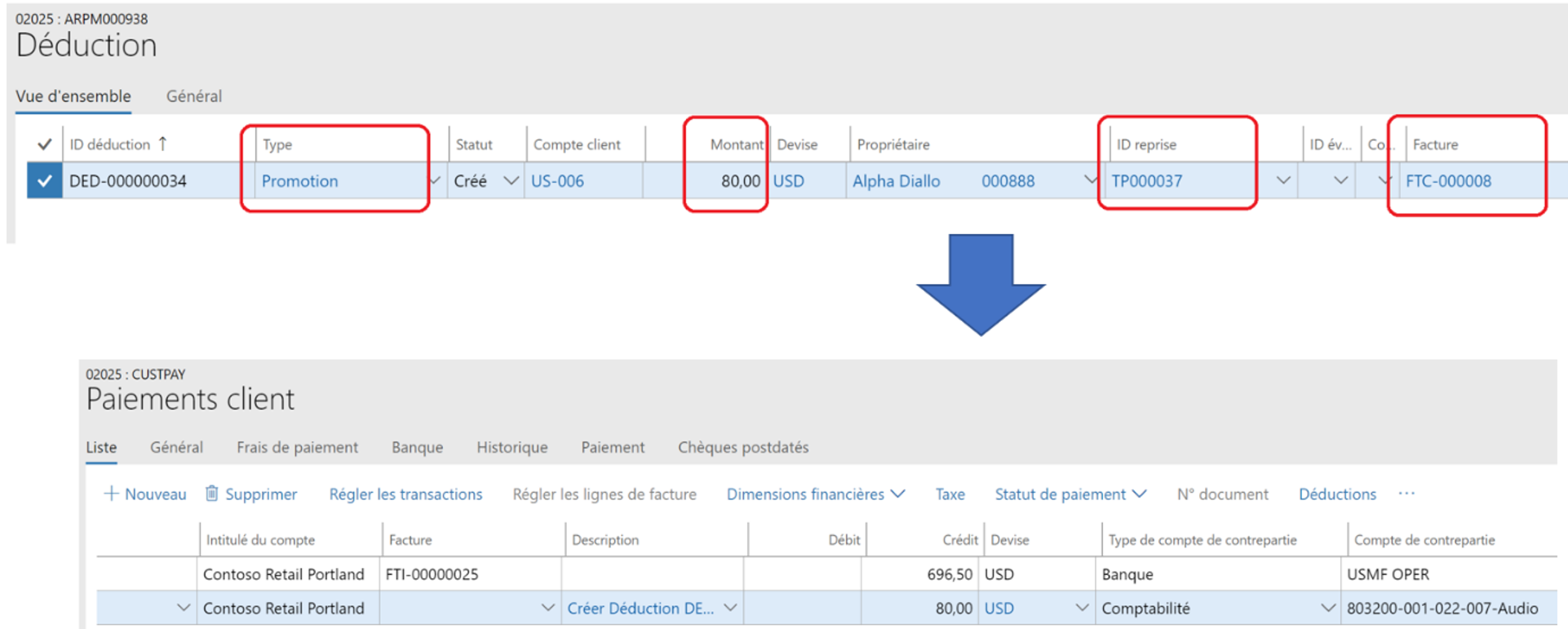

You need to fill the ID agreement to make the link with the existing trade allowance agreement for lump sum. Then you can setup the other fields, like the amount. Here let’s consider the customer has calculated on his own the same amount of 80 USD (as you can see above). Deduction are available in the trade allowance management module to help you to manage with the gap you may have between what you have calculated in your system and what the customer has on his own.

If you don’t use that Deduction button, you cannot achieved the Deduction management in the trade allowance management module. In a accounting business perspective, it’s may be not the good solution because the classic way to manage that is to register what the customer has done, and, if there is any gap, you should wait at first of the payement of the customer (for what’s left to pay), or settle this with a general ledger journal.

Anyway, you notice the 80 USD have been added in Credit, meaning the customer is going to pay you for 80 USD instead of receiving 80 USD ?

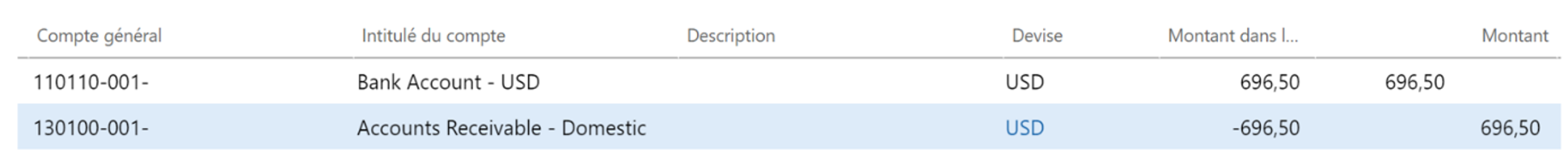

Let’s post the payment journal and analysing the ledger entries.

Here is the first line about the invoice, nothing particular here, seems correct.

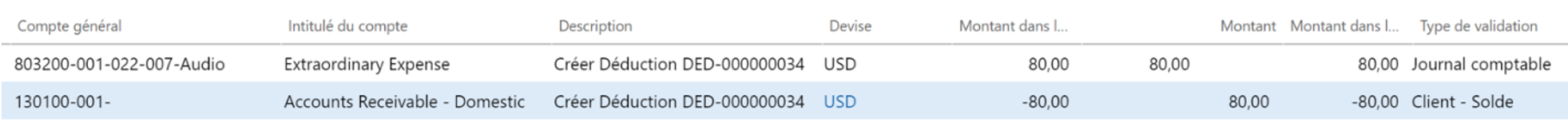

Here is the second line applied on the deduction.

As you can see, the 130100 account has been credited of 80 USD. So here the account transaction has been registrer twice : one for the FTC-000008 and another time for the deduction. Not good !

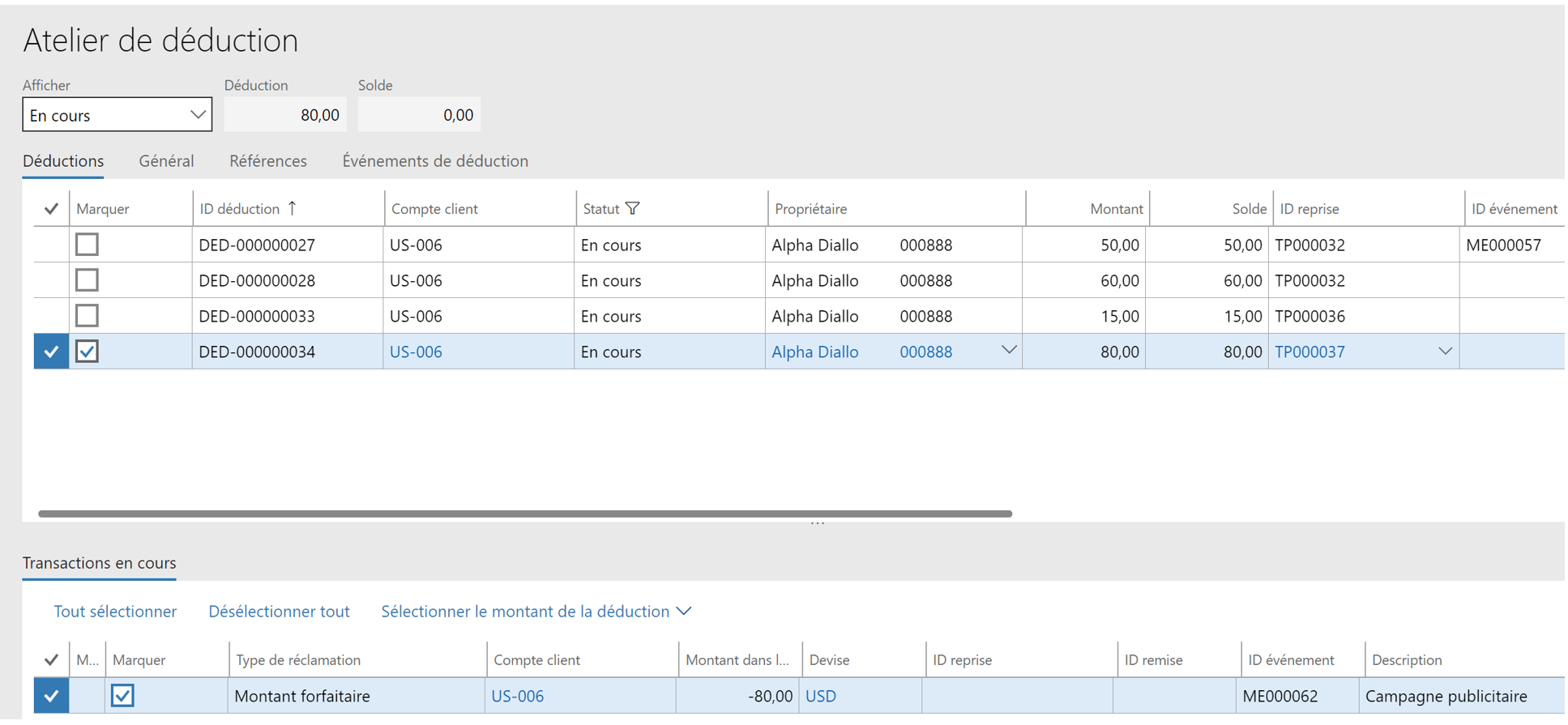

Going back to the deduction management, in the trade allowance management module, you can make a mapping between the free text invoice registered in your system and the deduction registered in the previous payment journal.

Here it’s fine, there is no gap. But if there is any, you can here accept, deny, or split the gap.

That is something you cannot do if you haven’t linked any deduction with the payment journal. But I wouldn’t recommand to do that because you will make some wrong account transactions…

I have not find any KB helping solve this situation so if you have done better let me know (Actually there is some KB about deduction but not about this case…).

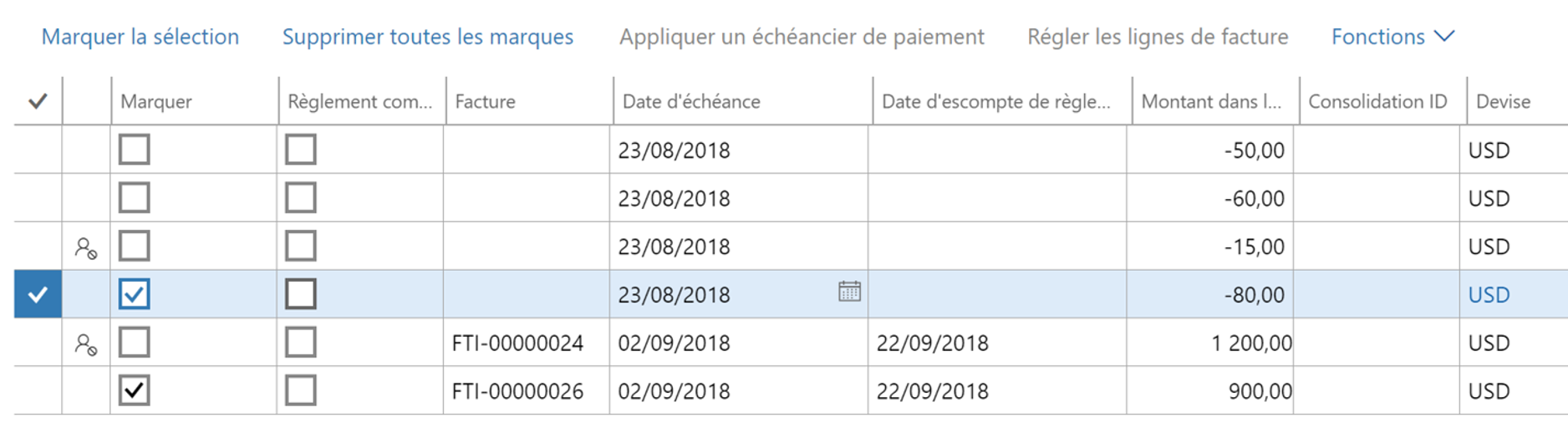

If you really want to use the 80 USD as a credit note for this customer, you need to wait having another invoice to pay, and then use the settle transaction button.

Then you can retrieve the -80 USD. You can mark the line and that’s good.

Solution

What I suggest to proceed here is to avoid using the Deduction functionnality when using Lump sum. You can proceed to the payment of any invoice, then you click on the settle transaction button, and find the free text invoice generated at first when approving the lump sum. Here you will see the amount is properly calculated and that’s it. You post and you’re good. The only thing is you cannot use the deduction functionnality available from the Trade allowance management module, but who cares ? You can manage deduction by ledger transaction journal as advised before.

That’s all for now .

Yohann

3 comments