Version Française disponible ici

Stock valuation is a huge topic, applied in manufactured and trade contexts. I don’t know any experienced ERP Dynamics consultant who hasn’t seen in his carrier a stock valuation issue. We can talk about that on plenty subjects. Here is a tutorial of how you can immediately register the goods received with a different stock value than the purchase price applied.

The standard behavior in D365FO is to valuate the product receipt with the purchase price, meaning you receive for 10$, it’s valuated to 10$ (or the defined standard cost), until the stock closing in run.

In some contexts, you may want to add indirect charges of a percentage when receiving the goods. It’s something common as long as the financial team is able to justify it.

You may consider adding auto charges to each purchase order lines, but then you will have some issues when invoicing for control validation: you have ordered for 10$ and received an invoice of 10$, then you add some charges which don’t appear in the invoice? No way, you will have trouble when you will be controlled by financial auditors. With internal charge? You will see the impact only in the ledger accounts and not in the physical or financial amount neither the cost price.

So here is a quick tutorial of how to setup this using the costing sheet. Usually costing sheet is used for adding direct and indirect charges on manufactured products, but in this tutorial you will see that we can use it also for trade products.

Setup cost groups and costing sheet

Using the costing sheet is the easiest solution that will calculate the stock valuation in real time when receiving the goods. You need to run some setup first.

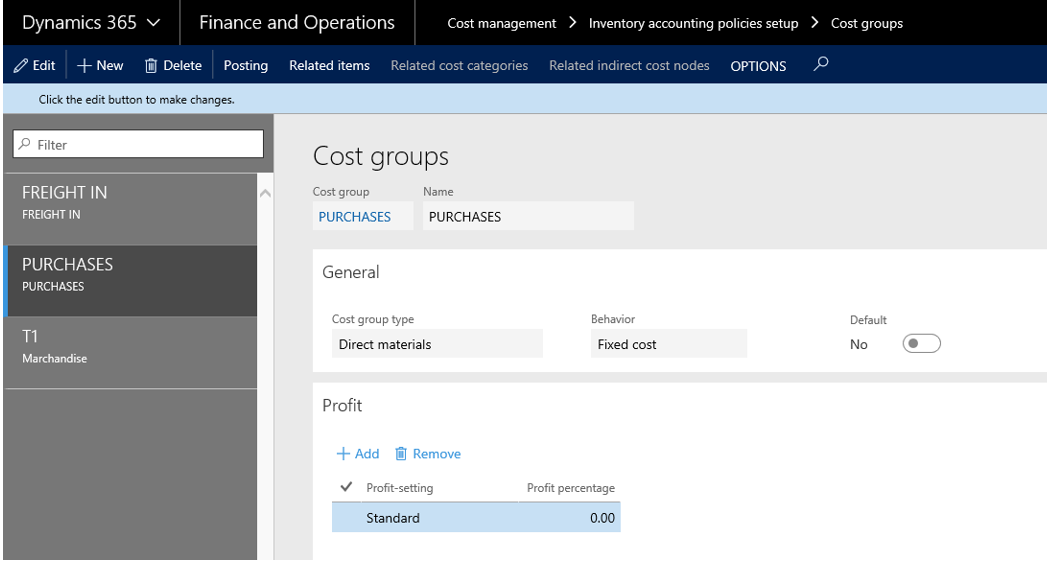

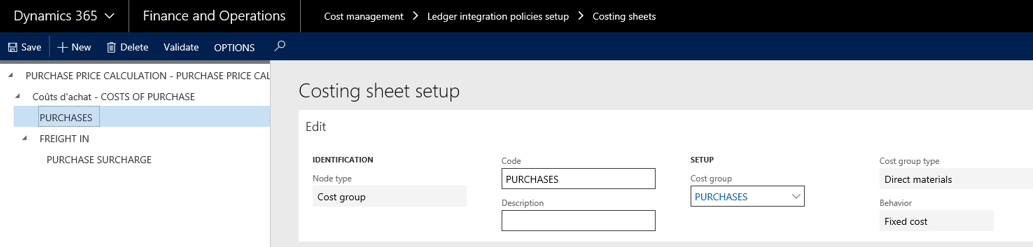

First, you need to create at least two different cost groups. Here is the Purchases one, setup as direct materials.

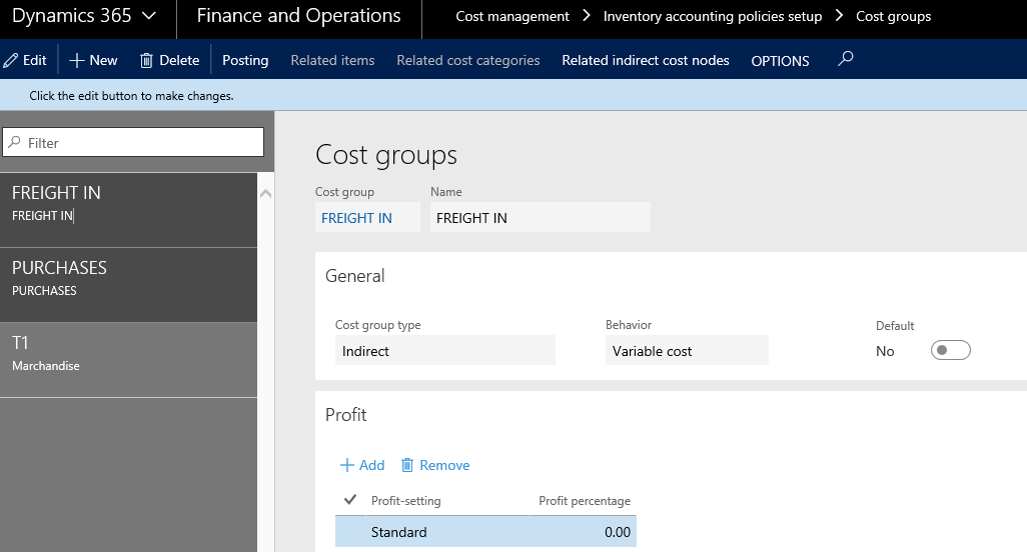

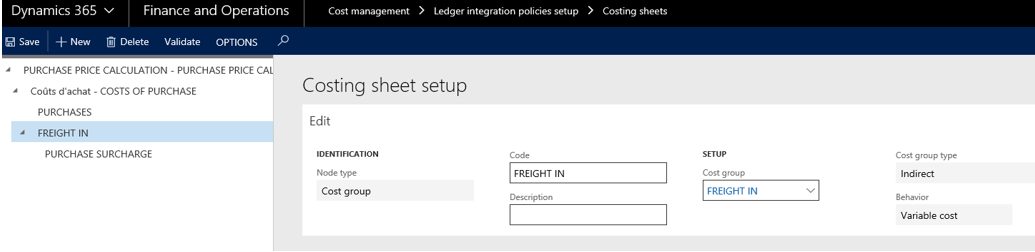

You can create a second one which will be used for supporting the indirect charge.

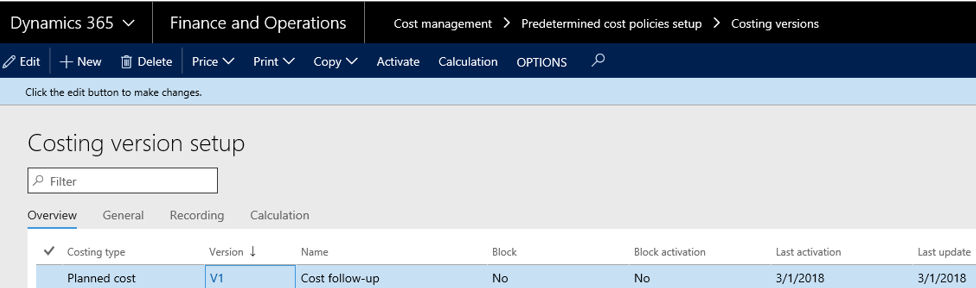

You will also need a costing version for planned cost. Don’t do anything particular but do not forgot to setup Block and Block activation to no.

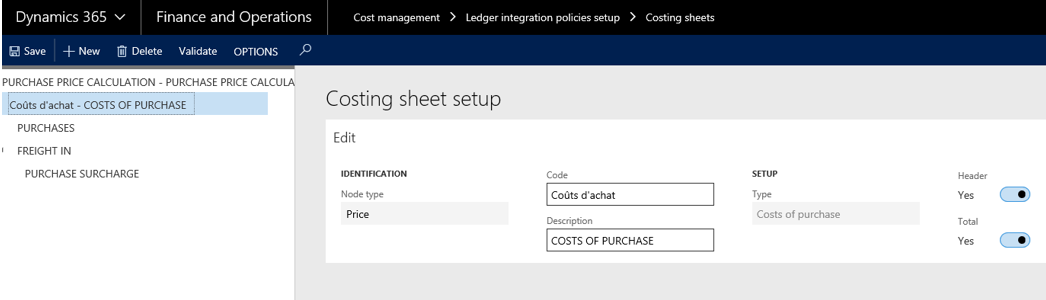

Then you will create the costing sheet. Remember, only one costing sheet for the whole legal entity. You need to handle it considering all subjects of your company.

Here is the structure I have setup.

Step 1: Initialize the costs of purchase line from the root.

Step 2: Add a line to specify you want to apply some charge on the Purchase cost group

Step 3: Add and indirect cost group type by using the Freight in cost group

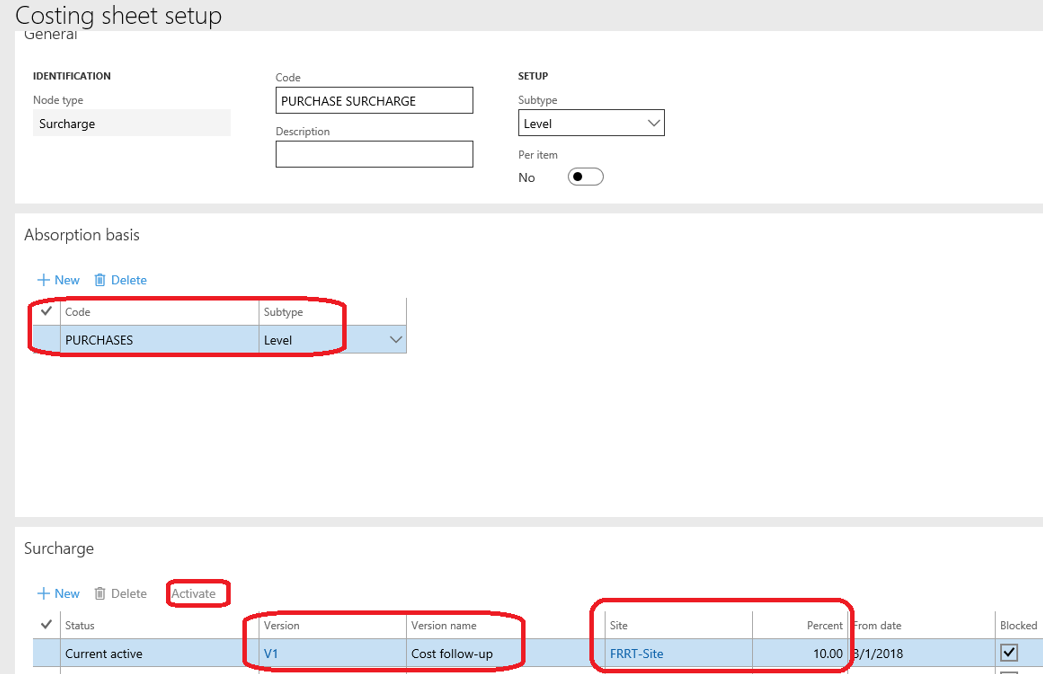

Step 3: Add the indirect charge applied on the Freight in cost group, by using an absorption basis of the Purchases cost group. You then specify in the Surchage tab the previous costing version created, and the percentage you want to apply. Below that (not visible in the screenshot), you can specify the account used. Don’t forget to activate the Surchage, and save the costing sheet.

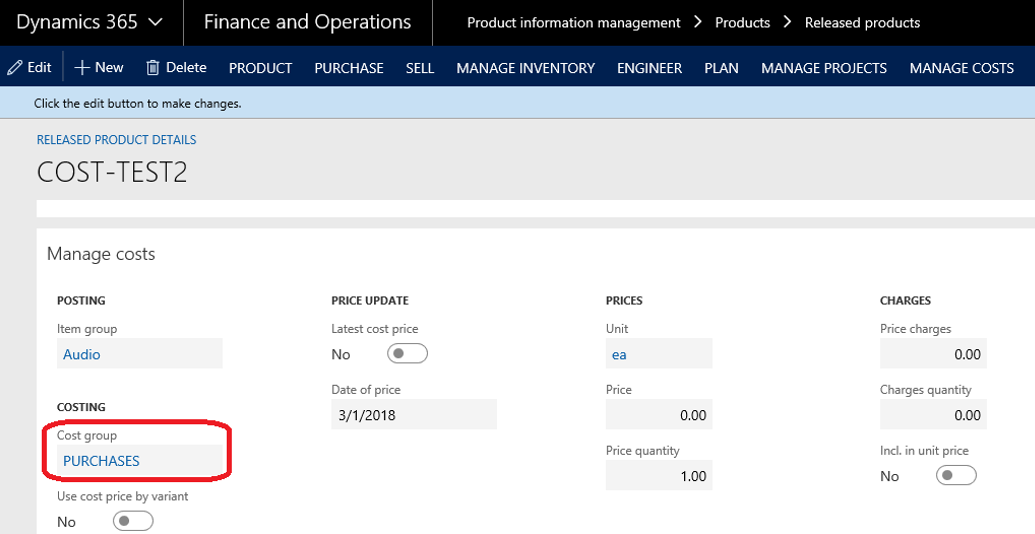

Now let’s switch to the trade item. On it you just need to allocate the Purchase cost group.

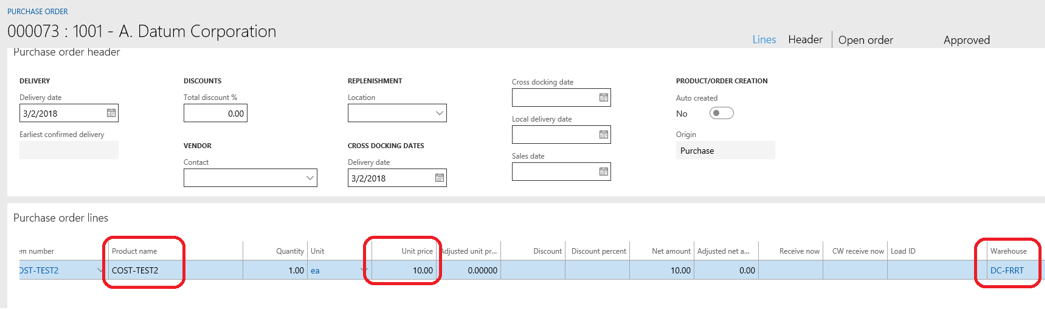

Here we go for a purchase order

It’s time to test it. Create a new purchase order, add the previous item and confirm the purchase order. You can move on to the product receipt and generate it.

So I’m purchasing an item for a unit price of 10 USD.

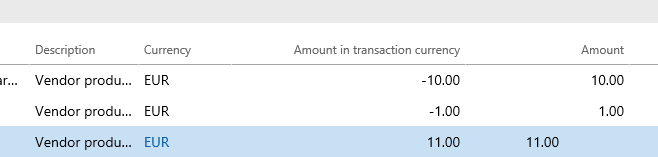

On the product receipt voucher, you can see the markup has been taken into account according to the ledger accounts setup in the costing sheet.

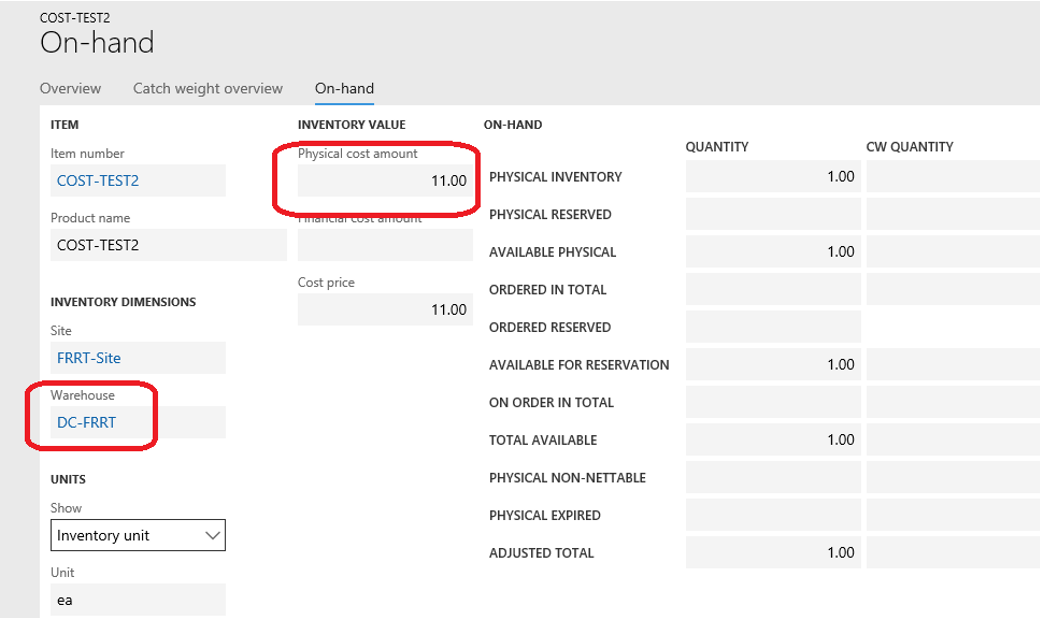

As you can see below, I’ve received one item but for a physical cost amount of 11 USD (10 USD + 10%).

That’s it !!!

Yohann

PS : Thanks to Anthony Vachon for his help.

2 comments